Retirement contribution limits 2024

Each year, the government limits the amount of money that can be saved and invested in retirement accounts. These accounts are sheltered from taxes until age 59.5, so there are limits on how much tax benefit the government is willing to give America’s workers. The good news is that there is typically an increase each year, and 2024 will be no different.

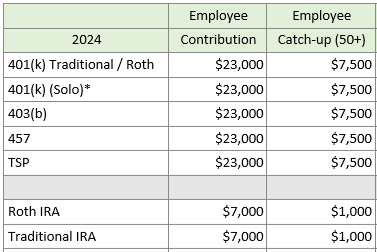

Workplace Plans

The contribution limit for most workplace retirement plans, including 401(k), 403(b), 457, and Thrift Savings Plans will increase to $23,000. Employers 50 and over will be able save an additional $7,500 for a total of $30,500.

Individual Retirement Accounts (IRA)

IRAs will have a $7,000 contribution limit with an extra $1,000 for those 50 and over. This also represents an increase over 2023.

Health Savings Accounts (HSA)

While not necessarily a retirement account, Health Savings Account (HSA) contributions increased to $4,150 for an individual and $8,300 for a family contribution, with both allowing an additional $1,000 for those 55 and over. For HSAs the catch-up is 55+, different than the 50+ catch-up age for other retirement plans.

HSAs are often used as a way to pay for medical expenses before or during retirement, and can even be used as other retirement income.

To learn more about which retirement plans are right for you, how much to contribute, and how it fits into your overall financial plan, contact me or schedule an appointment today.