Defined Benefit (DB) Plans

A type of pension plan in which an employer promises a specified pension payment and/or lump-sum upon retirement. The amount of the payment is typically derived from a combination of years of service, age, and compensation.

A traditional pension is a defined benefit plan.

Defined Contribution (DC) Plans

A type of retirement plan in which the employer, employee or both make contributions on a regular basis. The amount available at retirement depends on the amount contributed and the returns on the investments. The primary types of defined contribution plans explained below.

Common defined contribution plans include 401(k)s 403(b)s and 457 plans.

Defined Contribution (DC) Plan Types

-

401(k)s

For-profit institutions

Money grows tax deferred

Plans may offer a company match

Traditional and Roth options may be offered

10% penalty if distributed prior to age 59.5

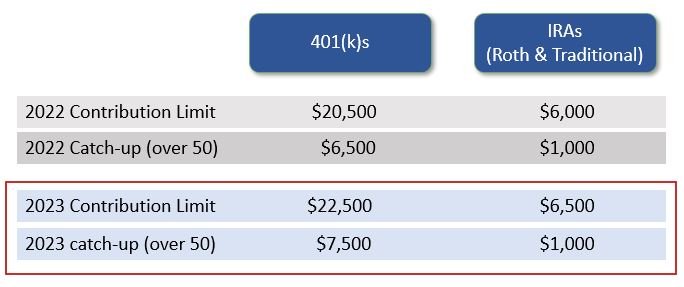

Annual Contribution limit (2023) = $22,500

-

403(b)s

Non-profit and government institutions

Plans may offer a match but not likely

Traditional and Roth options may be offered

10% penalty if distributed prior to age 59.5

Annual Contribution limit (2023) = $22,500

-

457

457(b) - for state and local government employees

457(f) - for non-profit executives

High contribution limits within three years of retirement

No penalty for distributions prior to age 59.5

Annual Contribution limit (2023) = $22,500

-

Thrift Savings Plan (TSP)

For federal employees and uniformed service personnel

Money grows tax deferred

Plans may offer a company match

Traditional and Roth options may be offered

10% penalty if distributed prior to age 59.5

Annual Contribution limit (2023) = $22,500

Retirement Plan Contribution Limits

IRAs

IRAs are not offered through an employer. Individuals may open an IRA through a financial institution.

Types of IRAs include traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. Most people have a traditional or Roth IRA. SIMPLE IRAs are for companies with 100 employees or less and the SEP IRA can be opened by the self-employed.

Money held in an IRA usually can't be withdrawn before age 59½ without incurring a penalty of 10% of the withdrawal.

There are annual income limitations for deducting contributions to traditional IRAs and for contributing to Roth IRAs.

Contribution limits on IRAs are lower than those on defined contribution plans (currently $6,500 per year)

Social Security

A government run retirement benefit. Employees pay into social security through taxes that are taken out of their wages. At retirement age (currently no earlier than 62), employees can begin to receive benefits based on age, years of employment, and compensation.

Delaying social security can increase benefits.

Full retirement age is 66 (born prior to 1955), 67 (born 1955 or later)

People may elect to take benefits as early as 62, though benefits will be reduced.

Benefits can be delayed until age 70. There is no benefit delaying beyond age 70.

Non-Retirement Accounts

Many people save money outside of retirement accounts. This may include;

Brokerage accounts that allow the buying and selling of securities

Bank accounts

CDs

Real Estate investments

Life insurance policies

Annuities

For more information see saving and investing