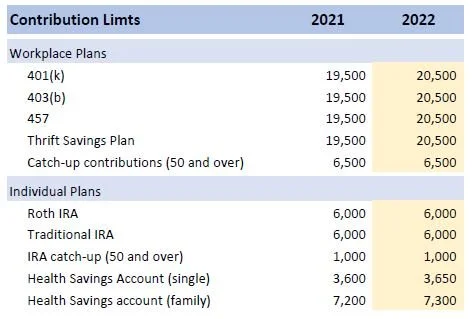

Retirement contribution limits for 2022

Every year the government reviews the total amount savers are allowed to contribute to their retirement plans and determines if they will adjust for the coming year. This amount is also called the elective deferral limit. A few minor changes are being made for 2022.

Know the maximum contribution limits for accounts you have and take full advantage of them if you can. If you have any questions you can book an appointment with me or submit a question online using Ask Frank.

401(k), 403(b), 457, and Thrift Savings Plans will see an increase in the elective deferral by $1,000 to $20,500

IRA contribution limits will stay the same

Catch-up contributions for those 50 and over will remain the same for both workplace and individual retirement plans

HSA accounts will see a modest increase in the contribution limits for both single ($50) and family ($100) contributions